- Be registered in six credits or more at the time of disbursement.

- File the FAFSA.

- Be enrolled in a certificate or degree program (not as a guest student).

- Be meeting Satisfactory Academic Progress.

Before making a request, review the borrowing limits below so you understand the maximum amount that could be approved. Depending on your previous borrowing history you may not be eligible for the full amount as Federal Direct Loans have annual and lifetime limits. Mid's Financial Aid team will review and adjust your request if needed.

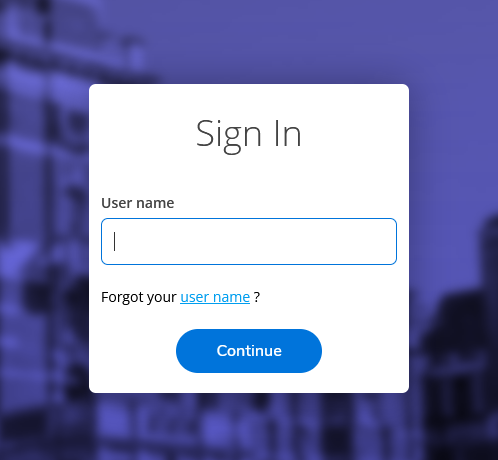

STEP 1 | Login to Self-Service and select Financial Aid.

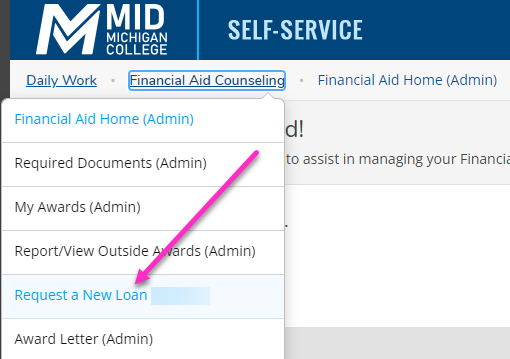

STEP 2 | Select the Financial Aid menu at the top and click Request a New Loan.

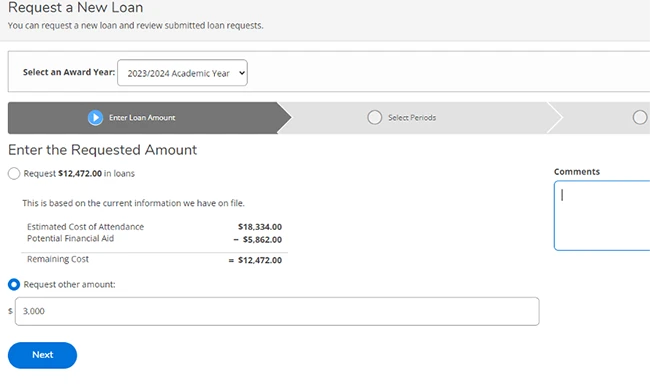

STEP 3 | Select the academic year, enter your request amount, and any additional comments if there is information you wish to share with us regarding your loan request.

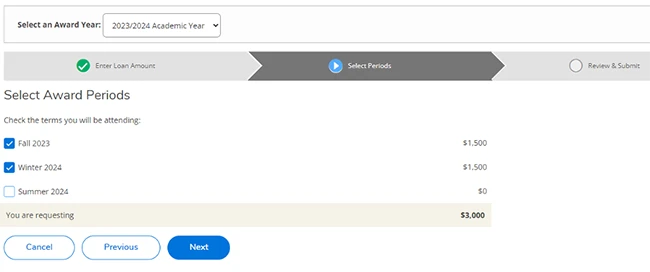

STEP 4 | Click Next and select the terms you will be attending.

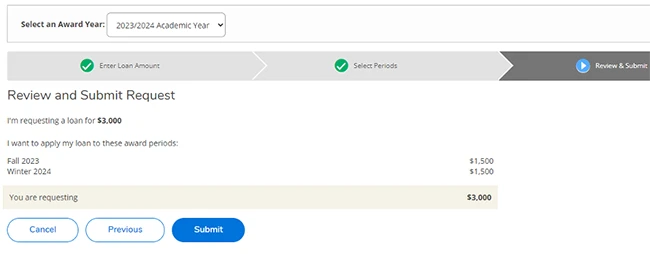

STEP 5 | Click Next and review the request.

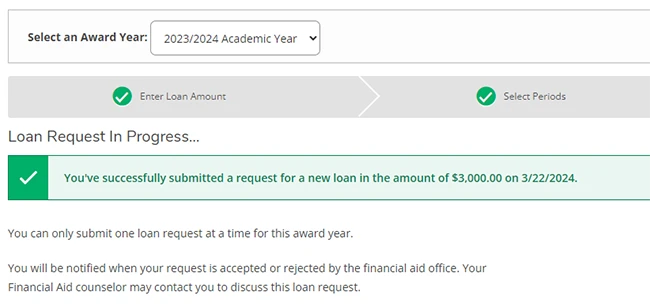

STEP 6 | You will receive a success verification screen.

Important Information Regarding Your Loan Request

- You may not be eligible for the full amount of the loan requested due to federal loan limits and program regulations.

- The amount that may be listed in Self-Service for a request amount does NOT factor in federal loan limits and could be larger than what we can approve.

- You will receive an email in your Mid Mich Email account letting you know if the loan was accepted, changed, or rejected.

- Once the loan is processed it will be visible in Self-Service along with any additional requests such as completing a Master Promissory Note and Entrance Counseling.

- It can take up to two weeks for a loan to be fully processed depending on the time of submission.

First Year Undergraduate 0 - 24 earned credits

- Dependent Student $5,500

- Independent Student* $9,500

Second Year Undergraduate with 25+ earned credits

- Dependent Student $6,500

- Independent Student* $10,500

*Also dependent undergraduate students whose parents are unable to obtain a PLUS loan due to not meeting credit requirements.

6.39% Fixed*

*Subsidized and unsubsidized loans first disbursed on or after July 1, 2025 and before July 1, 2026.

1.057% Origination Fee*

- This fee is taken before loan funds are disbursed to the school. The amount posted to your bill will be less than the requested amount as these fees have been deducted.

- The borrower is still responsible for the full amount borrowed.

*Loan fee effective on all loans disbursed on or after October 1, 2020.

Visit the Federal Student Aid website for the most current rates.

The following must be completed before a loan can be disbursed.

- Loan request submitted and confirmation of acceptance received.

- Completed MPN (master promissory note)*

- Completed Entrance Counseling*

- Final High School Transcript submitted to our office (must have the graduation date on it)

*You may have completed these steps in previous years. Log in to Self-Service and review your Financial Aid checklist items. If items are listed then you need to complete them.

Disbursement Schedule

One week before the bill due date all steps must be completed. Any incomplete loans will be canceled as of this date.

Before aid can be disbursed, we must verify your participation. After participation is verified, aid is disbursed only to those students who meet financial aid eligibility and have fulfilled all requirements.

Approximately 6-8 weeks after the start of the semester loans will be posted to student accounts.

- Loans are generally split into two equal disbursements over fall and winter semesters.*

- You must be enrolled in a minimum of 6 credits at the time of disbursement.

- If this creates a credit on your account and you are entitled to a refund, that will be available after disbursement.

*Exceptions | Students graduating after the fall semester or starting in the winter semester. A one-semester loan will be made in two disbursements during the semester.

Exit Counseling

If you previously received a subsidized or unsubsidized loan and are no longer enrolled at least half-time, which includes withdrawing or graduating from Mid Michigan College, you are required to complete Exit Counseling. You will receive an email in your Mid Mich Email account regarding this requirement, including the next steps, if you are required to complete Exit Counseling. If you plan to enroll at another institution, you still must complete Exit Counseling as there is a break in your full-time enrollment.

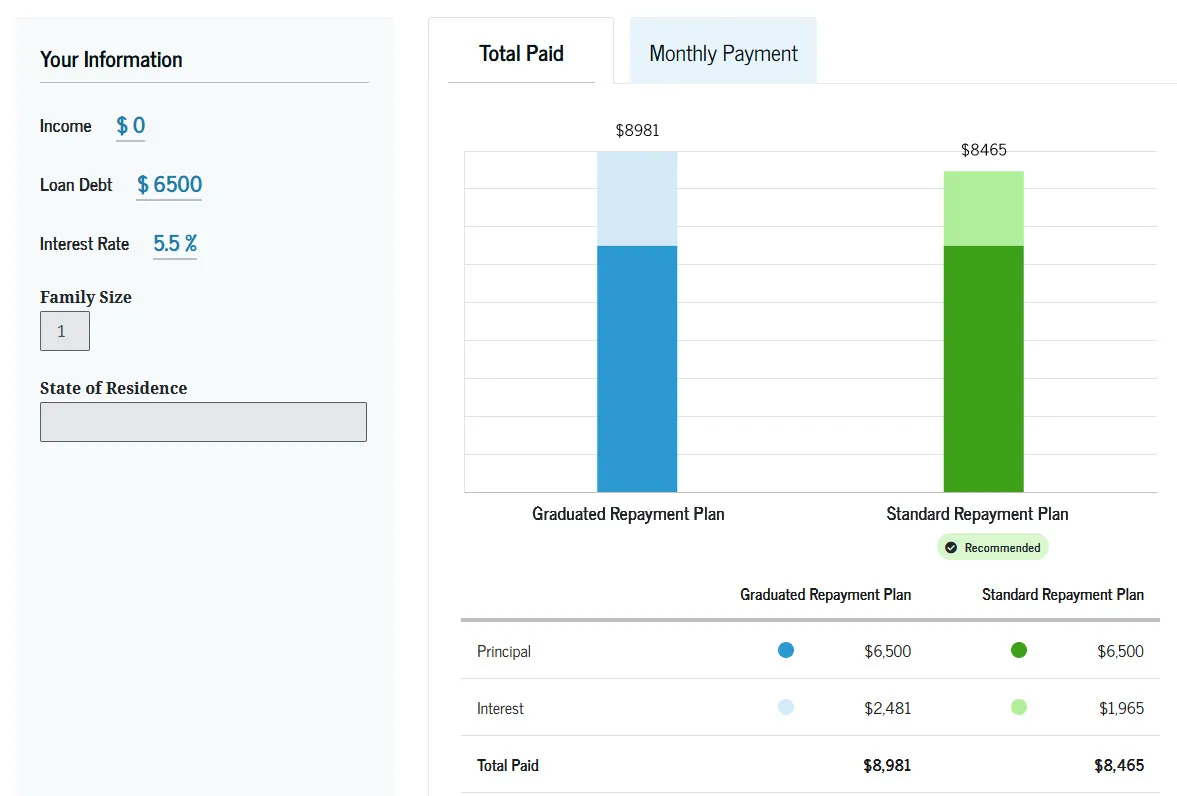

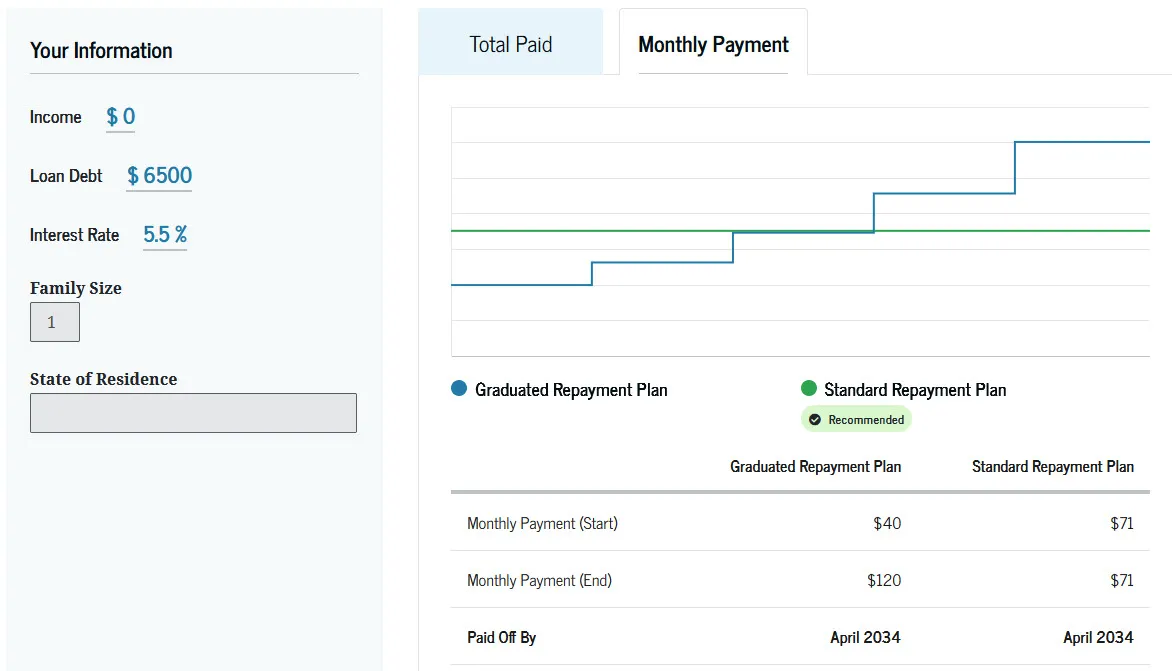

Loan Simulator

- See Your Federal Student Loan Repayment Options with the Loan Simulator.

- The Loan Simulator helps you calculate student loan payments and choose a repayment option that works best for you.

Student Loan Forgiveness

Remember, if you have missed a payment or are having trouble making payments, immediately contact your loan servicer to discuss potential options.

Student Loan Repayment via Inceptia

You’re not alone when it comes to student loans. Mid Michigan College has partnered with Inceptia, a division of the National Student Loan Program (NSLP), to provide you with FREE assistance with your Federal student loan obligations to ensure successful loan repayment.

Inceptia’s friendly customer representatives may reach out to you during your grace period to answer questions you have about your loan obligation and/or repayment options. They may also contact you if your loan(s) become delinquent. Inceptia is not a collection agency. We’ve partnered with them to help you explore a variety of possibilities such as alternative repayment plans, deferment, consolidation, discharge, forgiveness, and forbearance options. Inceptia will stay in touch with you via phone calls, letters, and/or emails to help you find answers to your questions and solutions to your issues.

For additional resources, including information on repayment options, visit Inceptia’s Federal Student Loan Overview website.

I no longer wish to borrow my loan how do I cancel it?

Send an email to finaid@midmich.edu and include the information below. This must be done within 14 days of the disbursement posting to your account. We email your Mid Mich Email account notifying you of your 14-day window. If it is past 14 days, contact Mid's Financial Aid team to see what options may be available.

- Your Full Name

- Student ID number

- Loan Type(s) (i.e. subsidized, unsubsidized)

- Amount you would like to cancel

If you cancel your loan(s) you may be left with an outstanding balance. Arrangements will need to be made immediately to pay this balance.

A cohort default rate is the percentage of a school’s borrowers who enter repayment on certain Federal Family Education Loan (FFEL) Program or William D. Ford Federal Direct Loan (Direct Loan) Program loans during a particular federal fiscal year (FY), October 1 to September 30, and default or meet other specified conditions before the end of the second following fiscal year. Refer to the Cohort Default Rate Guide for a more in-depth description of cohort default rates and how the rates are calculated.

Mid Michigan College’s current Cohort Default Rate is 0%. Learn more about how to avoid defaulting on a loan.